As people get closer to retirement age, the question of how to secure a comfortable retirement becomes more pressing. One way to achieve this goal is through the use of annuities. An annuity is essentially an agreement between an individual and an insurance company, in which the individual pays a lump sum or series of payments to the insurance company in exchange for regular income payments during retirement.

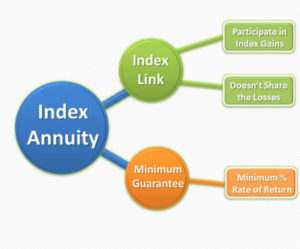

One type of annuity that is gaining in popularity is the fixed indexed annuity. Unlike traditional fixed annuities, which offer a guaranteed interest rate over a set period of time, fixed indexed annuities allow the investor to participate in the gains of a stock market index, while also providing a guaranteed minimum return. This means that the principal investment is always protected, while the investor has the potential to earn higher returns than with a traditional fixed annuity.

There are several benefits to including fixed indexed annuities in a solid retirement plan strategy. First and foremost, they provide a level of stability and predictability that can be valuable in uncertain times. With the principal always guaranteed, investors can have peace of mind knowing that their retirement income will not be impacted by market fluctuations.

Additionally, fixed indexed annuities can help diversify an individual’s portfolio, providing a source of income that is not tied to the stock market. This can be especially important for individuals who are nearing retirement or have a low risk tolerance.

Another benefit of fixed indexed annuities is that they offer tax-deferred growth. This means that investors do not have to pay taxes on any earnings until they withdraw the funds. This can be a significant advantage for individuals who are in a higher tax bracket during their working years but expect to be in a lower tax bracket during retirement.

In conclusion, fixed indexed annuities can be an important tool in a solid retirement plan strategy. They offer a guaranteed minimum return, potential for higher returns, diversification, and tax-deferred growth. As with any investment, it is important to carefully consider the options and consult with a financial advisor to determine if a fixed indexed annuity is the right choice for your individual needs and goals.

DM for more information.

Julio (Ricky) Gonzalez, RMIP